Following are the types of donations and tax benefits granted to Fundem’s partners who support our program of purchase of territory for its conservation.

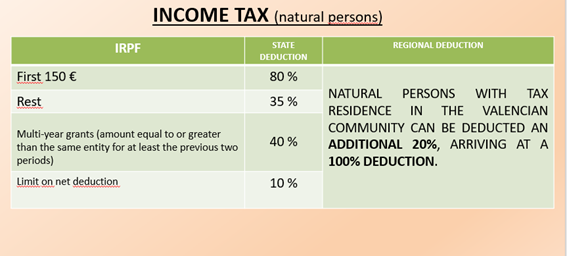

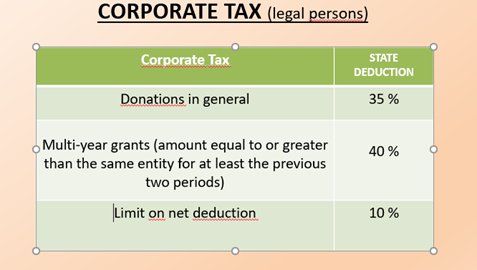

The deductions are those provided for in Law 49/2002, of 23 December, on the tax regime of non-profit entities and tax incentives to patronage, modified its percentage by Royal Decree Law 17/2020, of 5 May; as well as those provided for in Law 13/1997 of 23 December regulating the autonomous section of personal income tax and other taxes transferred (modified by Law 20/2018, of 25 July, of the Generalitat, of the cultural, scientific and non-professional sports patronage in the Valencian Community)

MEMBERSHIP FEES

NATURAL PERSONS WITH TAX RESIDENCE IN THE VALENCIAN COMMUNITY:

| DONATIONS | TAX DEDUCTION | WITH YOUR FEE FUNDEM ACQUIRES: |

| Annual fee: 30 € (student, pensioner, unemployed) | 30 € | 60 sq.m of land |

| Annual fee: 50 € (general) | 50 € | 100 sq.m of land |

| Annual fee: 75 € (Family: 2 adults and 2 children) | 75 € | 150 sq.m of land |

| Annual fee: 150 € (Protective member-Id.familiar) | 150 € | 300 sq.m of land |

NATURAL PERSONS WITHOUT TAX RESIDENCE IN THE VALENCIAN COMMUNITY:

| DONATIONS | TAX DEDUCTION | WITH YOUR FEE FUNDEM ACQUIRES: |

| Annual fee: 30 € (student, pensioner, unemployed) | 24 € | 60 sq.m of land |

| Annual fee: 50 € (general) | 40 € | 100 sq.m of land |

| Annual fee: 75 € (Family: 2 adults and 2 children) | 60 € | 150 sq.m of land |

| Annual fee: 150 € (Protective member-Id.familiar) | 120 € | 300 sq.m of land |